INTRODUCTION

There IS Another Way

| BEN & JERRY’S |

STONYFIELD FARM |

THE BODY SHOP |

| FOUNDED: 1978 |

FOUNDED: 1983 |

FOUNDED: 1976 |

| SOLD: 2000 |

SOLD: 2001 |

SOLD: 2002/06 |

THREE SOCIALLY RESPONSIBLE BUSINESSES, three iconoclastic sets of entrepreneurs, three epic journeys, a single shared end: sale of the company to a new group of owners, an end to the era of founder control, and serious questions about the future of each company’s commitment to the values that made it special. In the case of Ben & Jerry’s, the founders were forced out by a decision of the public shareholders to sell to Unilever. With Stonyfield Farm, the owner decided to sell to one of its multinational competitors, Groupe Danone, in an effort to extend its reach. The Body Shop went public in 1984 but remained closely held and controlled by its founders until the early 2000s, when they tried, unsuccessfully, to sell the company and subsequently removed themselves from day-to-day operations. In March 2006, the firm was acquired by the French cosmetics giant, L’Oréal.

The three stories hit my personal radar in close enough proximity to make me wonder whether there was a fundamental flaw in our thinking about socially responsible business. Was there something peculiar to these businesses that made it impossible for them to stay independent and still grow to scale? Was the whole socially responsible business movement doomed to remain marginalized in the land of mom-and-pops? Would we have to give up our dream of changing the world by changing the way the world does business?

Or were there alternatives?

This book began with more questions than answers. The overriding question was whether (and how) socially responsible businesses could “scale up” without compromising their core values. Specifically:

- Could they compete on price while absorbing social and environmental costs?

- Could they obtain financing for their multiple-bottom-line values from single-bottom-line sources?

- Could they grow big enough to matter without losing the essential values of their “small is beautiful” corporate cultures?

- Could they be good global competitors without becoming bad local citizens?

- Could they build new cooperative structures that would successfully compete with conventional economies of scale?

- Could the businesses be sold without selling out their values?

These are some of the questions this book attempts to answer for entrepreneurs who are struggling with them in the present—or hoping to be successful enough to struggle with them in the future.

As Ben Cohen and Jerry Greenfield wrote in their business biography, Ben & Jerry’s Double-Dip,

[We] believed that business was a machine for making money. Therefore we thought the best way to make Ben & Jerry’s a force for progressive social change was to grow bigger so we could make more profits and give more money away. We’d decided to give away 10 percent of our profits every year. Ten percent of the profits of a $100 million company could do a lot more good than 10 percent of the $3 [million] or $4 million we were currently doing.… We decided to go to the next level.1

For many mission-driven entrepreneurs, the desire to “go to the next level” in order to do more good in the world is equivalent to the conventional entrepreneur’s desire to grow the business in order to make more money. Sometimes the desire to grow is based on a desire to give away more money, as it was for Ben and Jerry; more frequently, it’s based on a desire to extend the benefits of the business’s core environmental or social value proposition to a broader market. And in some cases, for mission-driven entrepreneurs as well as their more financially driven counterparts, growth is an imperative—not a choice. In some industries, “grow or die” is a fundamental business reality, whether they like it or not.

Gary Hirschberg, the legendary CEO of Stonyfield Farm, the organic yogurt company that he sold in 2001 to multinational Groupe Danone, ran into those dynamics long before the company sold:

Our problem was that the yogurt was a huge hit. The demand far exceeded what we could produce. But we were losing money on every sale.… Commercial yogurt making is very capital intensive. This was not about getting big. It was about getting to a scale that could be profitable.

Also, you face the problem that supermarkets charge slotting fees to carry your product.… Once you enter the supermarket—but by no means do I want to implicate only the supermarket—once you’re in the marketplace, unfortunately, the pie theory takes over. The universe is only so big; the market is only so big. And if you don’t grow, and someone is growing faster than the market, then you shrink. In other words, your slice shrinks. And unfortunately, shelf space—which is the Holy Grail in my business—and shelf position, which is a subset of shelf space—are completely dependent on who’s delivering more profitability.

You know, the supermarket’s little secret of my business is that they don’t make money selling food, they make it selling real estate. And you have to be competitive to even hold your place, let alone grow it.2

I began this book with three theoretical perspectives on scale. The first had to do with conventional economies of scale and whether those realities might somehow be at odds with the ideals of social enterprise or mission-driven firms. The second pertained to the “small is beautiful” arguments originally made by E. F. Schumaker in the 1970s3 and recently extended by Michael Shuman and others to embrace the idea that “local is beautiful.”4 The concern there was whether the intrinsic values of “small” and “local” might somehow trump the virtues of scale—that big might be bad, period. The third was a set of ideas, coming from multiple sources, that had to do with “mass customization”5 and notions about “appropriate” scale. Were there, perhaps, some intermediate approaches that could combine the virtues of both big and small?

Conventional Economies of Scale

While it is popular among some business critics to argue that the drive for growth is fueled by simple greed and power lust, that argument has at best only partial validity. Much of the drive toward growth in business has to do with economies of scale, a value-neutral idea that is both simple and intuitive: in many (but not all) production systems, the more units you produce, the less each unit costs.

The classic example of economies of scale is the proverbial widget factory with a set of fixed costs that remain the same regardless of the number of widgets produced. It costs a certain amount of money to build the plant, turn on the lights, run the equipment, warehouse the inventory, ship goods to market, and sell the goods to customers. While some of these costs are variable—that is, directly related to the volume of goods produced—many others are not. They are the same whether the factory produces a hundred widgets or a thousand.

What changes with volume is the amount of these fixed costs, or overhead, that must be covered by each unit sold. If the fixed costs are, say, $100,000, and the plant produces 100 units, each unit must be priced to recover $1,000 in fixed costs alone. But if the same plant produces 1,000 units, each unit can be priced to recover only $100 in fixed costs. In competitive, capital-intensive industries, such economies of scale frequently determine the winners and losers.

But the concept of scale is by no means limited to manufacturing operations. Economies of scale, including those sometimes referred to as economies of “scope,”6 are a factor in most, if not all, businesses. It costs a certain amount of money to open a store, hire an employee, buy a truck, build a computer system, or install a phone line—and those costs are the same whether the store is crowded or empty, the employee is busy or idle, the truck is empty or full, the computer system is processing 100 transactions or 1,000, the phone is handling 3 calls or 300.

But the advantages of scale extend well beyond the ability to recover fixed costs. Bigger enterprises have a much easier time commanding the attention of suppliers, channel partners, and customers. On the supply side, companies that get to scale are able to earn volume discounts and favorable terms. In the channel, those companies can afford to pay the slotting fees and build the consumer demand that secures a bigger and better position on the shelf. And on the consumer side, size confers an advantage in the ability to reduce prices (thereby further increasing volume) and spend more money on marketing.

All this matters to the mission-driven entrepreneur because some of our most deeply held mission commitments—to local employment and livable wages, company cultures that feel more communal than corporate, organic products grown close to home—fly in the face of conventional economies of scale. The challenge is to find a way to maintain those commitments while meeting or beating the competition and, at the same time, to “scale up” our enterprises to serve larger groups of customers and have a greater impact on the economy as a whole.

Fortunately, the difficulty of this challenge is partially ameliorated by the diseconomies of scale that are also inherent in larger enterprises. These diseconomies are sometimes purely a creation of management in the form of bureaucratic decision-making processes or excessive corporate overhead. A classic example is the situation of a product manager in a large multiproduct, multinational enterprise who has difficulty getting the necessary corporate approvals to respond in a timely manner to a local competitive threat. Many a wonderful opportunity has been spawned in a niche that was too small or unprofitable to be served by the 800-pound gorilla in a given product category.7

In other cases, the diseconomies are a function of the very capital investments that were supposed to lead to scale economies. Even in an industry as scale driven as steel, technology advances have brought down the giants of history and awarded the future to the upstart owners of the newer mini-mills. When technology shifts, the traditional assets that created economies of scale can quickly turn into huge liabilities. And when markets shift rapidly—as increasingly they do—flexibility may be far more important than scale in maintaining both customer satisfaction and overall profitability. This is good news for small producers.

Potentially dwarfing all of these traditional diseconomies is the emerging issue of transportation costs. Just as cheap transportation made globalization possible, so expensive transportation is likely to make localization more attractive. At some point, the expected increase in transportation costs may very well overtake the production savings in lower labor costs or capital-intensive global manufacturing facilities, leaving some of today’s large-scale competitors with “stranded assets”8—and creating new opportunities for smaller local producers.

Although this is a book about scale and the drive to become bigger, economic shifts that help smaller producers also help values-based firms, largely because they reduce the need for outside capital, one of the most problematic issues for mission-driven firms. Since most capital providers are still operating in a single-bottom-line world, it is difficult to find investors who can fully support the values and timetables of many mission-driven firms. Anything that can be done to reduce a firm’s dependence on outside capital is likely to increase its ability to hang on to its core values as it grows.

Small Is Beautiful

Going to scale is not for everyone. Beginning with E. F. Schumaker’s highly influential 1973 book Small Is Beautiful, several generations of entrepreneurs have formally repudiated the drive for quantitative growth and made a compelling case for the personal, social, and (to a lesser extent) business benefits of remaining small. Today, such businesses are sometimes referred to as “lifestyle” businesses—that is, businesses that are driven by the owner’s desire to live a certain kind of life or build a business reflecting a certain set of values—rather than by traditional financial imperatives. In many cases, “small” has also come to mean “local,” and the lifestyle and values being championed are grounded in community.

One of the things that were most striking to me in my research was the extent to which the people I interviewed did not embody the small-is-beautiful ethos. By and large, they expressed remarkably little nostalgia for the Good Old Days of their small beginnings and very little ambivalence about the growth they had achieved. Because they had built their businesses to support values they believed in, they embraced growth. As long as they were able to maintain their focus on mission (which all of them were), bigger was better.

As Ray Codey, director of development at New Community Corporation, in Newark, New Jersey, put it, “Small is not necessarily beautiful if the problems are big.”9

Appropriate Scale

The notion of appropriate scale is appealing. Bigger is not always better, and small is not always beautiful. Arguably, what matters is “right sizing”—being “big enough.”

The answer for each organization lies somewhere at the intersection of mission and margin. The organization must be big enough to achieve its mission while maintaining a satisfactory financial return, whatever that may mean in any given instance. In thinking about this, it makes sense to keep in mind strategy guru Michael Porter’s admonition to avoid getting “stuck in the middle.”10

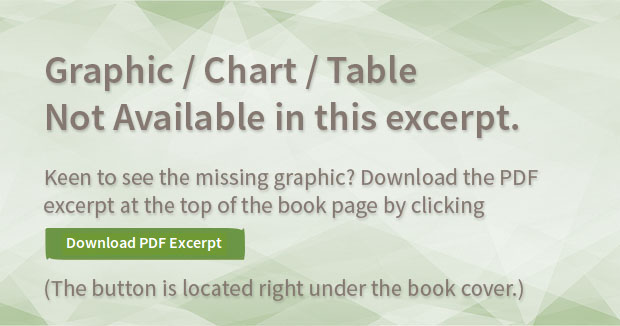

Many industries exhibit a U-shaped relationship between profitability and scale, as shown in the figure below.

Profitability and Scale

As the figure shows, smaller niche players can be highly profitable, usually by charging a premium price; and larger, massmarket players can be highly profitable, usually through economies of scale. What is problematic is trying to achieve profitability between the two poles. As Michael Porter has written,

The firm stuck in the middle is almost guaranteed low profitability. It either loses the high-volume customers who demand low prices or must bid away its profits to get this business away from low-cost firms. Yet it also loses the highmargin businesses—the cream—to the firms who are focused on high-margin targets or have achieved differentiation overall. The firm stuck in the middle also probably suffers from a blurred corporate culture and a conflicting set of organizational arrangements and motivation system.11

An “appropriate scale” may thus be large or small, but will probably not fall in between. This is an important point to keep in mind when fashioning a strategy for going to scale—and it may explain why so many promising small companies, mission-driven or not, fail to make the transition.

About This Book

This book has two target audiences: today’s successful mission-driven entrepreneurs—and tomorrow’s. I say “successful” because I assume that an enterprise must have achieved some level of success to have earned the right to grapple with questions of scale. As for tomorrow’s mission-driven entrepreneurs, I believe their chances of success will be greatly improved by thinking ahead of time about issues of growth, scale, exit, and legacy.

The book is organized around nine key lessons I took away from two years of research and some 30 interviews with mission-driven entrepreneurs who are succeeding in growing their businesses to scale. They are an inspiring bunch, and whenever possible, I’ve let them use their own words to tell their stories. The people and companies are listed at the end of this chapter. A short summary of the nine lessons follows.

Mission comes first

It is no accident that the businesses included in this book are called “mission driven.” They truly are. Just as a relentless focus on the bottom line helps to align and rationalize the decisions in a financially driven firm, so the focus on mission serves as an organizational plumb line in these firms.

Any business can do it

This was the greatest surprise to me in the research for this book. I set out to cast a wide net in terms of industries and had absolutely no trouble finding mission-driven businesses in every segment I researched. Similarly, I thought that only some types of businesses would scale, but I found enough different approaches to growth to make me wonder whether that was true. Undoubtedly there are limits to both observations, but I didn’t find them—and was heartened by that!

Organic is the way to grow

This slower, more natural approach to growth came up over and over again, and my interviewees contrasted it with both the get-big-fast growth of the dot-com era and the target-driven growth models of conventionally trained MBAs. Mission-driven businesses tend to grow more slowly, and need to grow more slowly.

Finance your independence

“Bootstrapping”—that is, financing business growth largely out of revenues—is a time-honored tradition among entrepreneurs (or was until the dot-com era planted a get-rich-quick alternative in the brains of an impressionable new generation). For mission-driven entrepreneurs, the critical issue is independence—not growth—and bootstrapping is the best way to preserve independence. Fortunately, it is not the only way.

Build your values into the brand

It is a truism among green marketers that customers will not pay a premium for green products. On the other hand, all other things being equal (like the cardinal virtues of price, quality, and convenience), customers will choose values-based products over their competitors. And while customers won’t pay a premium for green products, they will pay a premium for products perceived to be of higher quality along other dimensions. And that premium price frequently translates into bigger margins, which can be used to further the mission.

Match manufacturing to mission

The good news is this: it is possible to manufacture products in the United States at a competitive and affordable price! And it’s also possible to manufacture products globally at prices even the poorest people can afford. Vertical integration, or owning multiple links in the value chain, appears to be the key. On the other hand, for mission-driven brand builders, outsourcing is the preferred manufacturing strategy—and makes it a whole lot easier to get started.

Morph early and often

As one of my mentors, intrapreneuring expert Gifford Pinchot III, likes to say, “There are no facts about the future.” Therefore, a business plan, while theoretically a blueprint of the business, is essentially a form of fiction. Reality is almost always different. Successful social entrepreneurs hold the mission constant but allow the market to determine the course of the business.

Form follows function

Mission-driven ventures come in all different flavors: for-profit, nonprofit, hybrid, public, private, co-op, employee stock ownership plans (ESOPs), community development corporations (CDCs), and forms that have yet to be invented. Each has advantages and disadvantages, but any legal form can support a mission focus (even publicly traded corporations, although that’s harder!).

The soft stuff is the hardest

Most business schools make a distinction between the “hard” stuff—that is, the kinds of problems that lend themselves to quantitative analysis—and the “soft” stuff, the kinds of “touchyfeely” issues that come up anytime you work with people. And as every business practitioner knows, the most difficult problems are almost always the people problems. In mission-driven firms, culture is part of the answer—and part of the problem.

But all of that is the map, not the territory. And it’s a rather crude map, abstracted from experience after the fact. What brings the territory alive are stories of the entrepreneurs who have actually made the journey and who may inspire the rest of us to strike out on our own.

Companies and Interviews

During the first half of 2005, I interviewed approximately 30 entrepreneurs who had succeeded in bringing their companies to scale. I identified them through magazine articles, Web research, membership in the Social Venture Network (SVN)12 and Co-op America Business Network (CABN),13 and personal connections. Whenever possible, I interviewed the founder or cofounder of the company, because I wanted to hear the whole story from the beginning to the present—how the company started, where it got its capital, what was easy, what was hard. I tried to ferret out new stories, ones that haven’t been overtold, because I wanted to get beyond the usual suspects and make sure there was a broader base of practitioners.

There is, indeed, a broader base of practitioners—in both numbers and variety. They are an interesting and inspiring group, remarkably humble considering their accomplishments, and genuinely eager to share their lessons with others seeking to use business as a vehicle for effecting social change.

Interviews

Apparel

American Apparel Inc., Marty Bailey—VP, operations

Birkenstock USA, Margot Fraser—founder; retired CEO

Eileen Fisher Inc., Susan Schor—chief culture officer

Hemptown Clothing, Jason Finnis—founder; president

Computers and Electronics

GreenDisk, David Beschen—founder; CEO

Consumer Products

Gardener’s Supply Company, Will Raap—founder; CEO

Give Something Back Business Products,14 Mike Hannigan—cofounder; CEO

Green Glass Inc., Sean Penrith—cofounder; CEO

Organic Specialties Inc. (Citrisolve), Steve Zeitler—cofounder; CEO

Seventh Generation Inc., Jeffrey Hollender—founder; CEO

Tweezerman International, Dal LaMagna—founder

Wild Planet Toys Inc., Jennifer Chapman—COO

Economic Development

Endeavor, Blair Pillsbury—VP, Latin America; Louise Hulme—director, finance and administration

The Green Institute, Michael Krause—executive director

KickStart, Martin Fisher—cofounder

New Community Corporation, Msgr.William Linder—founder; CEO

Upstream 21, Leslie Christian—cofounder

Food

Cascadian Farm (General Mills),15 Gene Kahn—founder; VP, sustainability

Country Natural Beef, Doc and Connie Hatfield—cofounders

Equal Exchange Inc., Rink Dickinson—cofounder; co-CEO

Frontier Natural Products Co-op, Andy Pauley—board chair; CEO

Great Harvest Bread Company,16 Mike Ferretti—president; CEO

New Belgium Brewing Company, Kim Jordan—cofounder; CEO

Organic Valley Family of Farms, George Siemon—founder; CEO

Pura Vida Coffee, John Sage—cofounder; president

Small Potatoes Urban Delivery Inc. (SPUD), David Van Seters—founder; CEO

Stonyfield Farm,17 Gary Hirshberg—founder

Medical

Project Impact Inc., David Green—founder

ScriptSave, Charlie Horn—founder; chairman

Paper

New Leaf Paper, Jeff Mendelsohn—founder; CEO

Services

Bright Horizons Family Solutions Inc., Linda Mason—cofounder; chairman

Trillium Asset Management Corporation, Joan Bavaria—founder; CEO

Village Real Estate Services, Mark Deutschmann—founder; owner

Working Assets, Laura Scher—cofounder; CEO

Transportation

Flexcar, Lance Ayrault—president; CEO

Novex Couriers, Rob Safrata—president; CEO

Westport Innovations Inc., David Demers—CEO